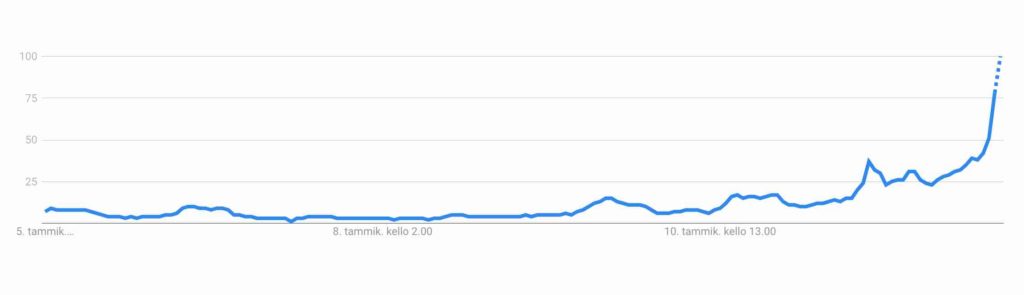

Now that Consumer Price Index (CPI) came out in USA we found out how it impacts the Google searches for Consumer Price Index. Yes, the searches are soaring. Why is that and how does CPI figures help companies to understand the economy and do pricing? So we will dig into the basics here.

What is a Consumer Price Index?

The Consumer Price Index (CPI) measures the average change over time in the prices consumers pay for a market basket of consumer goods and services. It is used to measure inflation and cost of living. So it tells a lot about where the purchasing power is heading. That said, that is why companies should monitor it. The Bureau of Labor Statistics (BLS) calculates the CPI for the United States.

How does it help companies to understand the environment they are in?

A company can use the Consumer Price Index (CPI) to forecast future demand by analyzing the relationship between inflation changes and consumer spending. Especially in their own store. Understanding quickly how much increasing inflation affect them, is crucial to make quick changes in their assortments and pricing. Here are a few ways a company can use the CPI to forecast future demand:

1. Identifying trends:

By analyzing historical data on the CPI and their own sales, a company can identify trends in how inflation and prices affect consumer spending patterns in their business. This helps companies predict how future inflation changes might impact their product demand and how to set prices in the future.

2. Analyzing customer behavior:

By understanding how their different customer groups are affected by inflation and price changes, companies can make more accurate predictions about how demand for their products will change. For example, if the company’s target market comprises primarily low-income consumers, they will be more sensitive to price increases.

3. Using inflation expectations:

A company can also take into account inflation expectations. If the inflation rate is expected to be high in the future, consumers may spend more now before prices rise.

4. Combining with other factors:

A company can also combine the CPI data with other factors that can impact the demand for its products, such as the state of the economy, consumer sentiment, and their marketing efforts. In many cases having high stock that can be offered affordably with relevant campaigning, a company can grow its customer base, whereas its competitors can’t.

How can you use Consumer Price Index in pricing?

In practicality, you can use the Consumer Price Index (CPI) in following ways:

Understand how your Cost of Goods Sold might change

You should use the CPI to track changes in the cost of your raw materials, purchase prices, labor, and other inputs, and adjust your pricing accordingly to maintain a desired outcome. It would help if you planned price changes so that your overall profit will also cover your operating costs. Although you would obtain a high gross margin it might mean you are selling less and then getting lower overall profitability than you earlier did.

Use inflation figures periodically

By monitoring the CPI periodically, you can anticipate changes in inflation and adjust your pricing in good time to maintain the value of your products. As above, measure closely how much you can raise prices to keep the demand focused on your products.

Understand how your competitors are affected by inflation

You can also use the CPI to estimate how changes in inflation and prices will affect the prices of similar products offered by your competitors, and adjust its prices accordingly to remain competitive. This is especially hard in retail where price changes might not be that often compared to Ecommerce, where prices change much more often. In cases where competitors use dynamic pricing software to change their prices it will be hard to predict what part of the price change is due to inflation.

Make clear estimation of overall consumer demand and how your customers react

One way you can also use the CPI to estimate how changes in inflation affect consumer spending patterns. Are there new products that you could offer? Is there products you should get rid of? Can you offer your most wanted items on more competitive pricing to maintain or increase demand for your products. NOTE: You should research and understand the prices of similar products that your competitors offer to remain competitive and maintain your market share.

Understand your brand positioning and brand value

Your pricing strategy should align with your overall brand positioning and target market. If you are the desired brand, most likely, you won’t be affected as much as the less desired ones. For example, if you are a luxury brand, you will more room to wiggle than companies targeting budget-conscious consumers.

How to modify your distribution and promotion strategy in an inflation

Lastly, you can also plan how your distribution and promotion works. Are you still able to keep up with your current distribution model or should you look for more cost-effective ways to do the distribution? Another factor that comes into play is also the role of promotions. When consumers’ purchase power decreases, they look for more offers. For many skillful Retail and Ecommerce companies, this time will open a niche to carve more market share with clever promotions to obtain new markets or consumer groups.

Understandably, companies look for latest details on consumer price index. Still, as with everything, it’s crucial to note that the CPI is just one of the many factors that can and should impact your pricing strategy. It should be considered against other data and use also broader market analysis. Hopefully you found this article useful. G

FAQ

Most frequent questions and answers

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services. It is used to measure inflation and cost of living.

The Bureau of Labor Statistics (BLS) calculates the CPI for the United States. The BLS collects prices for a representative basket of goods and services, and then compares the cost of the basket in the current period to the cost of the same basket in a base period. The percentage increase or decrease in the cost of the basket is the CPI.

The CPI is used to measure inflation and cost of living, and is also used as a deflator in the calculation of real gross domestic product (GDP). Additionally, it’s also used by companies to understand the economic environment they operate in, and adjust their pricing, wages, and other business decisions accordingly.

The CPI can be used to forecast future demand by analyzing the relationship between changes in inflation and changes in consumer spending, but it should be considered in conjunction with other data and market analysis, as well as other factors such as distribution costs, promotion costs, and competition.

The CPI is calculated differently in different countries, and may not be directly comparable. However, the Organization for Economic Cooperation and Development (OECD) and the International Monetary Fund (IMF) both publish purchasing power parities (PPP) that are used to compare prices across countries.