Highest inflation record!

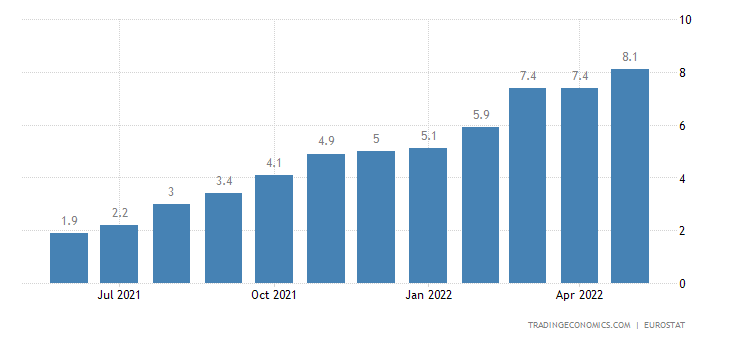

A record-breaking high inflation rate in the Euro Area is expected to happen according to Eurostat, the statistical office of the European Union. Indeed, the annual inflation rate has continued to increase in May 2022 from 7.4% to 8.1%. The high increase in energy prices is mainly driving the increase of the inflation rate.

This blog post will discuss:

So, without further ado..

What is price inflation?

Price inflation is the rate of increase in prices of a collection of goods and services over a period of time. In simple terms, high demand and low supply may lead to price inflation. Inflation can also be caused by an increase in production or service costs.

The current high price inflation in Europe is triggered by supply chain disruptions, caused by logistic challenges in the time of the pandemic. In addition, higher consumer demand post-pandemic, increases in energy costs and the war in Ukraine, are all contributing factors to increased inflation.

How can inflation be measured?

There are several ways to measure the inflation rate. One of the most popular metrics is the Consumer Price Index (CPI), which measures the overall change in consumer prices over time for a collection of goods and services (including food, cards, education and recreation).

Another measure of inflation is the Producer Price Index (PPI). The PPI measures the overall change in prices paid to domestic producers for their output. For instance, this includes prices for fuel, farm products, chemical products, and metals.

Both CPI and PPI are important metrics as they reflect changes in the prices of goods and services. While PPI is seen from the perspective of manufacturing, CPI is seen from the perspective of consumers.

How to adapt your pricing with inflation?

Most importantly, simply raising overall prices to manage inflation may damage customer relationships, pressure sales and hurt your margins. Re-pricing is necessary to maintain margins in a period of rising costs.

On a positive note, this re-pricing situation calls for a targeted pricing strategy. It can serve as an opportunity to clean up any pricing mistakes made in the past and drive more sustainable business growth.

Here are four practical examples of how you can adapt your pricing strategy:

1. Adjust less-profitable pricing decisions done in the past

- Review your product catalogue:

- reduce over-promoted items based on the category roles or decrease the number of promotions with little results.

- reduce the number of customer-specific items that are not profitable or universally sold.

- implement ‘shrinkflation’; that is, reducing the size of your product catalogue to meet more profitable margin or maintain the price point.

- group products together into bigger optimizable product groups.

- Analyze your customers: Revise unprofitable or overfunded customers.

- Review your service agreements: Adjust service pricing terms and conditions to align with market conditions (for example: a 30% – 50% increase in shipping cost over the last two years).

- Review your business & pricing strategy:

- re-examine the brand ladder strategy (for example, price parity between SKUs);

- construct a new (and delete the old) channel- and occasion-based pricing design based on the post-pandemic consumer behaviour and expectations.

2. Focus on effective communication

3. Explore alternatives beyond pricing to reduce costs

- reduce inventory level

- adjust the number of assortments

- minimize SKU complexity

- source from preferred suppliers

4. Develop a targeted pricing strategy

Calculate your products’ price elasticity with a free calculator

Way forward…

Learn more and identify the most optimal price for your product amidst the high inflation rate! Our intelligent software and AI could automate the process for you and help you increase your margins. Speak to our pricing expert or book a free demo!

Learn more about pricing strategies

All things about pricing & profit optimization right in your inbox. No spam.